Leaders Savings Accounts

We’re leading the way to financial freedom. Our Forward Suite of Savings share these features in common, making it easy to save and watch your money grow.

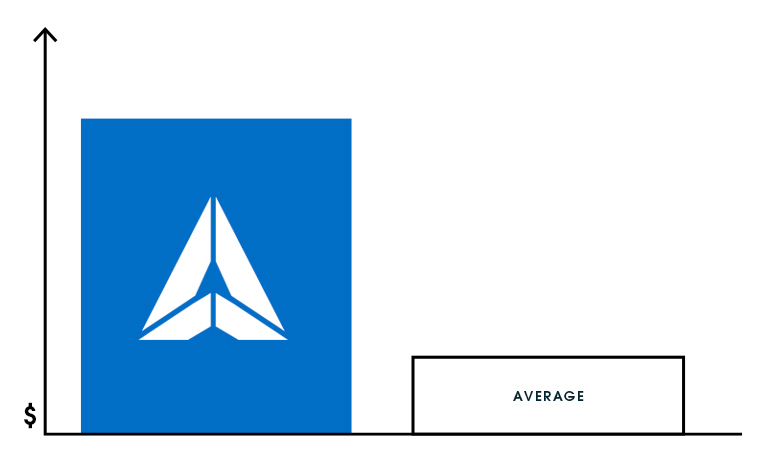

How Our Savings Accounts Stack Up

Our members earn more with rates that beat the national average.

Our membership savings is your first account with us to encourage saving with free access to online and mobile banking.

- $10 minimum balance to earn dividends

- Earn up to 0.10% APY¹

- Free access to mobile & online banking

It’s time to jump-start your savings with tiered dividends to help you grow your balance quickly. Automate your savings to achieve your financial goals.

- Earn up to 5.00% APY² on your first $4,999.99 of savings

- No minimum balance to earn dividends

- Automate savings via payroll deduction

Are you ready to aim high with your savings goals? Earn a great rate with no hoops to maximize your savings and reach your long-term goals.

- Earn up to 3.75% APY³

- No minimum to open or earn dividends

- No balance tiers

Take the stress out of holiday spending with our Christmas Club Savings Account. Automate savings via transfer or payroll deduction and watch your money grow all year long.

- No minimum deposit required

- Automate savings with payroll deductions

- Earn 0.25% APY¹ on your savings

Saving for your next vacation couldn’t be easier. With a Vacation Club Savings account, you can automate your savings to ensure that your next vacation will be stress-free.

- No minimum deposit required

- Automate savings with payroll deductions

- Earn 0.25% APY¹ on your savings

Kids who learn the habit of saving are most likely to enjoy financial freedom as adults. With tiered dividends to encourage savings, this is the account to set your kids on the road to success.

- Earn up to 5.00% APY¹

- Membership fee waived

- Incentives and rewards to encourage kids to save

Earn our most generous dividends when you buy a term share certificate. Choose a term between 3 and 60 months and watch your money grow.

- Flexible terms between 3 months and 60 months⁴

- Earn up to 2.50% APY¹

Do you want generous dividends with the ability to withdraw money if you need to? Our Money Market Certificate offers high earnings plus flexibility.

- Earn 1.25% APY¹ paid quarterly

- Penalty-free withdrawals

- $3,000 minimum deposit

Begin your retirement planning now with an IRA term share certificate. Choose from a Traditional, Roth, or Educations Savings Account (ESA) and earn some of our highest dividends.

- Earn up to 2.50% APY¹

- $1,000 minimum deposit

- Grow your money on a tax-deferred basis (with a Traditional IRA term certificate)⁵

The reviews are in

Don't take our word for it. Read why our members love banking with Leaders.

Owned by Members

Membership means ownership. As a not-for-profit credit union, we share rewards with our members in the form of dividends.

Competitive Rates

Our members benefit from competitive rates that are higher than most financial institutions.

Local Service

As part of the West Tennessee community, we’re proud to serve our members and neighbors with a smile.

Why Leaders?

Our goal is a simple one: to lead our members to the financial security they deserve.

Join NowStability

We’re one of the largest and healthiest credit unions in Tennessee, providing financial stability to our valued members.

Comprehensive Services

From basic banking services to sophisticated tools to achieve your financial dreams, we’ve got the accounts you need to reach your goals.

Owned by Members

Membership means ownership. As a not-for-profit credit union, we share rewards with our members in the form of dividends.

Competitive Rates

Our members benefit from competitive rates that are higher than most financial institutions.

Local Service

As part of the West Tennessee community, we’re proud to serve our members and neighbors with a smile.

Stability

We’re one of the largest and healthiest credit unions in Tennessee, providing financial stability to our valued members.

Comprehensive Services

From basic banking services to sophisticated tools to achieve your financial dreams, we’ve got the accounts you need to reach your goals.

Have questions?

One of our financial champions will be happy to guide you.

Find a Branch Near MeDisclosures

1. - APY = Annual Percentage Yield.

2. - Fast Forward Savings: 5.00% APY effective 3/1/2024. In order to qualify to receive interest for the month, the member must not withdraw from the account and have at least one (1) deposit for at least $20 (not including the interest from the account). If the member withdraws from the account, the member will not receive interest for the month. One FREE withdrawal per month, additional withdrawals are subject to a $5 fee. Account limited to one per membership.

3. - Forward Plus High Yield Savings: 3.75% APY effective 3/1/2024. This account offers the flexibility of no minimum opening balance requirement and no minimum to earn dividends. Maintaining a minimum balance is unnecessary to avoid service charges. Interest accrual extends up to a maximum of five million dollars.

4. - Term share certificates closed before maturity are subject to early withdrawal penalties. Certificates may be used as collateral for low-interest loans.

5. - There are specific guidelines for contributions and distributions of IRA funds. Please contact our IRA Department for more information at 731-664-1784

6. - Based on the national APY average on savings accounts in the US according to Bankrate as of 02/29/2024.

Your savings are federally insured to at least $250,000 and backed by the full faith and credit of the United States Government.